What is Virtual Offshore Captive Center?

VODC is our unique client engagement model that places the client into the shoes of the owner of an ‘Offshore Development/ Development/Captive Centre’ without actually having established/owning the same in the Offshore Jurisdictions.

The traditional outsourcing model (Process-Centric Outsourcing) has been transformed by us into “Virtual Offshore Development/Captive Centre ” for our clients to enable them to retain control over process/project management and robust governance besides substantial cost savings. This Engagement Model encapsulates all the advantages of ‘Offshore Development/Captive Centre ’ as well as conventional ‘third party outsourcing’ without undergoing the perils of setting up its own entity in offshore jurisdictions. This model ensures greater strategic value and builds up long term strategic client relationships through active collaboration with the client. In short, this model is a collaborative partnership model than a vendor model. This model, in-fact, is a modified version of “Co-managed Outsourcing model /Co-sourcing model”.

Under this model, the Clients collaborate with us as partners and like a traditional outsourcing model, outsource the process or a set of processes to us, while taking the full responsibility of process/project management and transition of the process. In today’s complex IT world, the quality and timely delivery of the Process outsourced are the key concerns and hold paramount importance. As the client assume the responsibility of process/project management through our assistance, the client will have higher degree of control over the manpower and resources deployed by us for the execution of the outsourced process/project in a more effective and efficient manner. This will help our client get enhanced competitive advantage and strategic value through enhanced productivity, cost effectiveness, better performance management and continuous process improvement

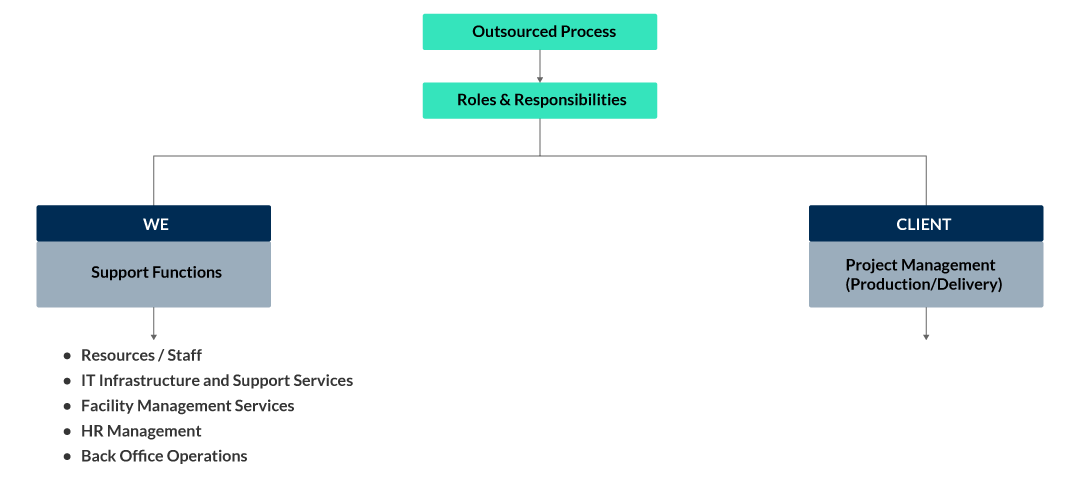

This Model is a type of strategic partnership, wherein both the entities work together and leverage their expertise & resources. This Robust Engagement Model ensures cost effectiveness, competitiveness, and is scalable, relationship oriented & free from outsourcing risks, for the clients. Under this model, the roles & responsibilities relating to the outsourced process will be defined collaboratively and will be managed. The outsourced process/ Project will be managed by the client and he will be responsible for the components of the Project management like Transition Management, Quality Management, Performance Management & Governance while we will be responsible for managing the IT infrastructure & support services, Back office operations like HR functions, Facilities Management etc. as part of our role and responsibilities. This Model, further, ensures greater outsourcing clarity, IT project & real time visibility, transparency and greater degree of risk management.

In short, our Clients get all the advantages of a dedicated Off-shore Development/Captive Centre(like High Quality & timely delivery, better performance, smooth transition etc), without the pitfalls (Entity issues like recruitment of resources, HR, Administration, regulatory issue, legal, Tax, , Accounts etc.) of having established its own entity in the Off-shore jurisdictions.

At the end, if our clients need, we transfer the entire things that were involved in the project to the client at a price that is pre-decide in line of Build, operate and Transfer. Under this Model, the roles & responsibilities will be as follows:

How It Works

Risks and Benefits Analysis

| Type of Risk | Traditional Outsourcing | Virtual Development/Captive Centre | Off shore Development/Captive Centre | BOT | Joint Venture |

|---|---|---|---|---|---|

| Process/Project Management risk | High | Low | Low | Moderate | Moderate |

| Quality risk | High | Low | Low | Moderate | Moderate |

| Timely Process / Project Delivery risk | High | Low | Low | Moderate | Moderate |

| Controls risk | High | Low | Nil | Moderate | Moderate |

| Transition risk | High | Low | Nil | Moderate | Low |

| Privacy & Security risk | High | Low | Nil | Low | Low |

| Governance risk | High | Low | Nil | Nil | Low |

| HR risk | Nil | Nil | Very High | Low | High |

| Regulatory risk | Nil | Nil | Very High | Low | High |

| Own Entity risk | Nil | Nil | Very High | Low | High |

| Transparency & Visibility | Moderate | Very High | Very High | Moderate | High |

Benefit Analysis

| Type of Risk | Traditional Outsourcing | Virtual Development/Captive Centre | Off shore Development/Captive Centre | BOT | Joint Venture |

|---|---|---|---|---|---|

| Process/Project Management Control | Moderate | Excellent | Excellent | Moderate | Good |

| Cost Effectiveness | Moderate | Very good | Very good | Moderate | Moderate |

| Timely Process / Project Delivery risk | Moderate | Very Good | Very Good | Good | Good |

| Quality | Moderate | Very Good | Very Good | Good | Good |

| Vendor Relationship | Moderate | Very Good | Not Applicable | Good | Ok |

| Capital Investment Savings | High | High | Nil | High | Moderate |

| Process improvements | Moderate | Very good | Very good | Moderate | Good |

| Out Sourcing Clarity | Moderate | Very good | Very High | Moderate | High |

| Real Time Visibility & Risk management | Moderate | Very good | Very good | Moderate | Good |

| IT Project Visibility & Productivity | Moderate | Very good | Very High | Moderate | Good |

| Seamless Transition | Moderate | Very good | Very good | Moderate | Good |

Transfer Method

- Resource Transfer OR

- Company transfer

Fee

a) Regular FEE

- Per seat per month starting from USD 750 depending on following factors :

- Shared Infrastructure

- Independent Infrastructure

- Number of Seats

- Special Specific Infrastructure

- Term of agreement

- Services

- Risks

- Reimbursement of Monthly Salaries on CTC Basis plus 20% mark up

b) Transfer Fee ( one time )

- A transfer fee is charged at the time of transfer of business with resources and assets which is based on average annual expenditure of last 2 years with a multiple starting from 1.5 depending on various factors

(c) Reimbursement of pre-agreed costs, if any.